**All links are at the bottom of the post, footnote style**

Procrastination Advice From an Unlikely Source

I happened to be listening to a very popular wealth building podcast the other day.

The advice they gave was against all good sense.

And yet they were right.

I’ll tell you more, but to understand, first let me tell you what kind of pain I deal with when it comes to procrastinating on the projects that are most meaningful to me.

I’m the kind of person who has a to-do list spreadsheet filled with projects and have the to-do items listed in order of importance. So the most important stuff is at the top.

When I open my spreadsheet in the morning, I see the most important thing first. It’s what’s on top of the list. On a good day, I sit down and get right to it.

But sometimes I get into a funk and don’t feel like doing the most important item that is next on my list.

I’m not always sure why I’m in the funk. Maybe it’s not getting enough zzzz’s, or not enough Yoga With Adriene, or it could just be hormones. (1)

Instead of moving forward, I’ll piddle around and find myself calling friends, cleaning baseboards, or having a staring contest with my cat Hero.

What to do?

Follow the money management guy’s advice. That’s what.

Who is the money guy?

His name is Dave Ramsey. He is a successful author and has one of the most popular radio shows in the United States. He teaches people how to get out of debt and become an everyday millionaire. (2)

How Does Money Management Advice Play Into Fighting Procrastination?

I’m happy you asked. I’ll explain it, but you’ll think I’m getting way off track.

There is a correlation between time management and money management. Time is money, as they say.

So let’s get started with figuring this out.

This is going to look like math, but it’s not…it’s a way to make a point.

Stick with me because this concept can help you get through your procrastination.

I’m going to explain the concept first through the lens of money first, and then we’ll swing back around and apply it to the time problem, the procrastination issue.

Are ya with me?

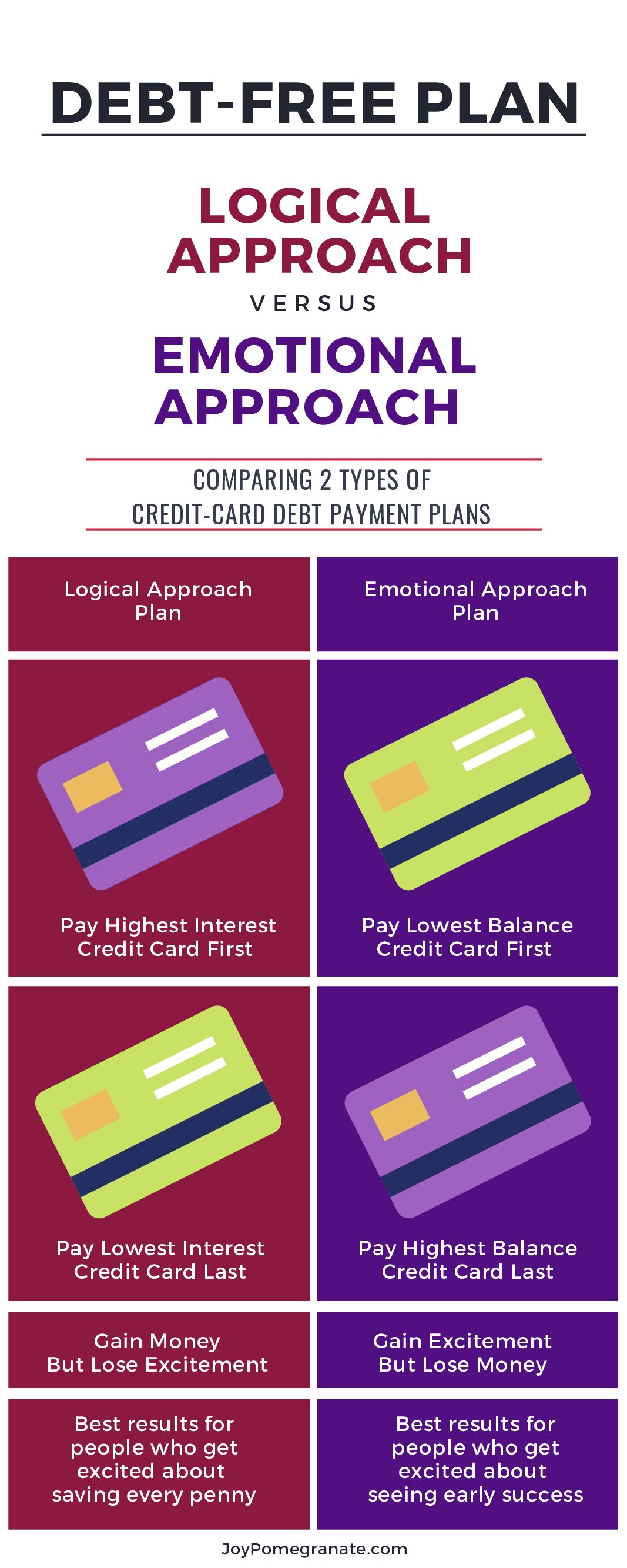

The Logical Way to Take Care of Debt

Pretend you’ve got a bunch of debt, like credit cards, student loans, car loans and the money you “borrowed” from your mom in third grade for those two ice cream cones.

They all have interest added to them every month.

Interest is not fun. It gets added on as you go, and continues to make your balance higher.

The higher the interest rate, the longer it takes to pay off your debt.

Therefore, the card or loan with the highest interest is your “most expensive” debt.

One of the first rules of financial freedom is to pay off your debts. No one wants to support banks with hungry pockets.

So, the logical approach to paying off your debt (recommended by most financial advisors), is to pay the minimum due amount on all of your debts, and then pay extra to your most expensive one.

You send extra money to the debt with the highest interest rate so you can pay it off sooner, because it’s so expensive. Makes sense, right?

When it’s paid, you look at which debt has the next highest interest rate and you start throwing extra money at THAT one. Of course, now you have extra extra money because you already paid the first debt off.

When you’ve paid debt number two off, you now have extra, extra, extra money, and you can apply all of that to your third debt, and so on.

Eventually they will all get paid off.

This method is called the “Avalanche” method of paying off your debt. In an avalanche, a large chunk of snow and ice release from the side of a mountain and it sweeps down, getting smaller as it goes.

The “Avalanche” gives you a picture of what you’re doing with your debt. You attack your most expensive card first, and when it’s swept away, you do the next, until you only have your cheapest debt at the end. It’s just a soft snow drift by the time you get towards the end.

If you understand this so far, you can skip this next section.

Let’s look at this more closely for those who aren’t quite following.

An Example of Logical Debt Reduction

Let’s look at just two credit cards for example.

CARD ONE: You owe Biggly Bank Credit Card $300.00.

It has a low balance, and it also has a low interest of 1% per year. This means you have to give them $3 for every hundred dollars you owe them each year.

So at the end of year one, they will have charged you $3 in interest. The next year they will charge 1% on $303.00.

I’m simplifying by the way. It’s much worse than this because they add part of this interest every month which makes the total go up even faster.

Stick with me. Don’t let your eyes glaze over, please.

Go get a cold wash cloth for gawd’s sake.

Here is something cute to look at for a moment to distract you.

CARD TWO: You owe Exotica Bank Card $2000.00.

But these guys are scary. They are charging you a whopping 20% a year. Holy cr*p! That’s expensive! After the first year they’ve added on $400 interest!

Yep. That’s bad.

So, logically, you should throw your extra money at your Exotica bank card first with the 20% interest rate. Then, when that is paid off, you’d take what you were paying Exotica and start paying your 1% interest debt over at Biggly bank.

Okay, so the opposite concept is….

The Emotional Path Toward Debt Reduction

Again, the traditional advice is to follow reasoning and logic to pay off your most expensive card first. You’ll end up paying less money in the long run.

The problem with that, Dave Ramsey says, is that most people lose their enthusiasm because paying down their debt is boring. In this case, paying off Exotica bank will take a long time because its got a $2000 balance.

What to do about the lost focus?

So, Dave Ramsey gave this advice: Pay off your lowest BALANCE first, not your highest INTEREST RATE.

Everyone thought he was crazy! When I first heard that, I thought “this guy has a screw lose…what terrible advice!”

I thought it was terrible because his plan will cost you more money in the long run.

So why was he giving that advice and why do I love it?

Because, every time you pay off a debt, you get excited. It feels great! You tell your friends..your parents…”I just paid off one of my cards!” and you feel more free!

By paying off the lowest balance first, you get a quick “win” under your belt. And you have a reason to pop open a champagne bottle sooner. (I hope you celebrate each win as you go)

And this is why it works. This makes you want to keep going! It feels good, so you continue to put effort into your plan. You stay the course.

Dave calls this the “snowball” effect in the finance world, because you start small (on the lowest balance) and you pick up steam as you go (ie: gather more snow on your snowball as it rolls down the mountain).

It’s emotionally satisfying. Get it? It costs you more, but you STAY in the game, because you’re excited, so you get it done.

With the logical approach, you may have given up because you’d think “this is going to take me forever.” There is less chance that you’ll give up and go back to adding on to your ever increasing debt.

But with the emotional approach you stay engaged!

Dave Ramsey is a genius!

Okay we’re done with the financial advice. So how does that help when it comes to procrastination?

Using the Snowball Effect for Project Management

Well, most days I (thankfully!) stay pretty motivated, but I have a down slump about once a month, where I don’t feel like doing much.

I find it’s hard to stay motivated, even when I try to connect with the excitement of the big picture. It’s just not happening.

I got to thinking.

What if I applied Dave Ramsey’s emotion-based “snowball” approach to my project woes?

What if I stop trying to get the most logical and important step done and do something on my list that is easier or more emotionally satisfying on my “off” days?

Normally, if I’m in a funk and try to do my “important” task, I give up. Well, I don’t outright give up. I keep finding “other things” to do, like dust my cotton ball collection. In other words, I procrastinate.

Is there something I can do fairly quickly that will make me feel like I’m closer to my goal?

Is there anything I can do that connects me with the excitement I had when I created this goal?

Can I pick up momentum little by little by tackling the easiest, most interesting task first, when I don’t feel excited about the hardest one?

I now let the snowball effect work for me on those days I’d rather pretend I’m a turtle and hide in my shell.

Now, on days I discover I’m avoiding my list, I ask myself what I could take on that’s a fast, easy, or fun task related to a project.

Ooooh, that sounds like a good plan, Michelle, so what would this look like?

I’ll give you a few examples.

Project Goal: Go Minimal In My Home

Priority item on my list: Arrange for the city to come pick up discarded furniture.

This sounds boring. Instead of staring at this logical next step and willing myself to get it done…only to find myself jumping on facebook, I look for something related that might be easier or more entertaining.

Here are some easier ideas for the Go Minimal project.

Option: Clean out the kitchen utensil drawer while listening to a fun podcast.

Option: See if my old books are worth anything online.

Option: Upload Stylebook and figure out if everything works in my wardrobe.

Does this help me move forward with my goal? Yes.

Is it the next thing I SHOULD be working on? No.

But it may spark the excitement I need to get it done.

Let’s look at another one.

Goal: Write a Song.

Priority item on my list: Finish the lyrics.

Ugh. That sounds daunting right now.

What about trying one of these instead?

Option: Dink on the piano and come up with a melody.

Option: Grab a guitar and decide on basic chords.

That would feel like a song was being written, right?

How about another big project?

Goal: Organize a Birthday Luncheon

Priority item on my list: Fill out the paperwork to secure the park pavilion.

Nah-uh. Not going to happen.

Option: Find a great recipe for spinach dip

Option: Call your friend and ask to borrow their cake plate.

Option: Create a song list.

Option: Decide on a napkin fold.

You get the idea.

Instead of procrastinating by watching another Netflix movie-of-the-month about a detective that solves crimes with his pet monkey, do something on your project that feels exciting or at least mildly interesting.

Sometimes a magical thing happens when you do this.

You work a little on an easier task and you start to feel the excitement about the bigger picture again and that motivates you to do the boring thing you’d been procrastinating on!

Even if it doesn’t, you’ve still moved forward and you won’t be sore at yourself.

If none of this works, you may just need a little self-care instead of project care.

Live Juicy, Joybird!

Posts

1 How to Start-Yoga With Adriene

Links

Infographic

Compare 2 Ways to Pay Off Debts: I did it! If you want to use it, credit me and link to my website

Photos

Take Too Long: Mikhail Nilov

In A Funk: Kelly L

Touchstones: Quang Nguyen Vinh

Hope Flower: Aaron Burden

Songwriter: Pixabay

Luncheon: Fu Zhichao

Take Flight: Pixabay